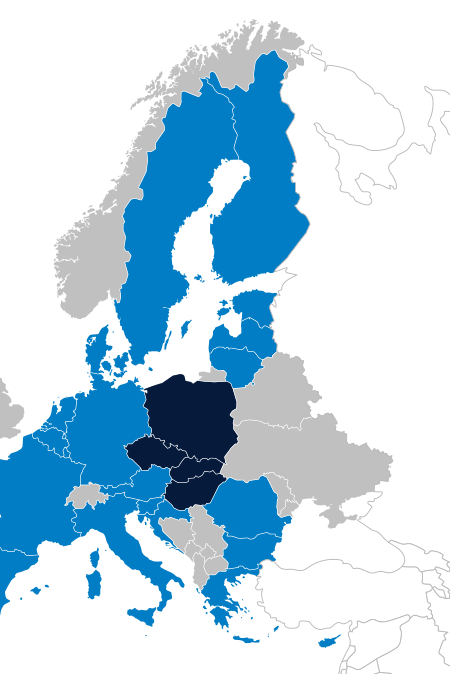

Chi Fu FT European Fund Management Zrt., founded in 2020 in Budapest Hungary, is a wholly owned subsidiary of Franklin Templeton SinoAm Securities Investment Management Inc. As fund manager, the Company boasts extensive investment experience in the European private equity market especially in Visegrád countries, namely, Czech Republic, Hungary, Poland and Slovakia. The Company manages the Chi Fu FT European Private Equity Fund, registered in September 2021. The Company invests in a range of sectors including green energy, IT, healthcare, consumer business, automotive and manufacturing.

Based in Budapest Hungary

We invest in the EU, a highly integrated and open single market consisting of 27 member countries. In 2021 the GDP of the EU amounted to €14 trillion. The market is vibrant and boasts with opportunities

Sustainable Growth Opportunities

We focus our efforts on growth. We believe in innovation driving strong and sustainable economies for many decades to come

Global Expertise

We are a wholly owned company by Franklin Templeton SinoAm Securities Investment Management Inc. With its global scale and operations, we are confident to grow and thrive through unpredictable economic cycles

Industry Focus

We target a range of sectors including green energy, IT, healthcare, consumer business, automotive and manufacturing

Our Approach

Sectors in focus

Strategies

At Chi Fu FT European Fund Management Zrt., we focus on investments that bring innovative ideas and growth opportunities to the market. We believe in long-term investments that generate considerable returns to our investors.

We focus on early-stage, turnaround and restructuring, succession management, buyout investment opportunities across the V4 region.

Philosophy

We capitalize on macroeconomic trends to identify risk and seek growth opportunities.

We aspire to be a partner to our portfolio companies as we invest more than just financial capital but also operating resources and industry expertise to enable long term growth.